By Linus Garg

First publised on 2021-07-28 14:46:19

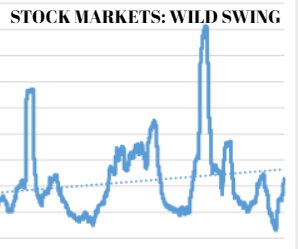

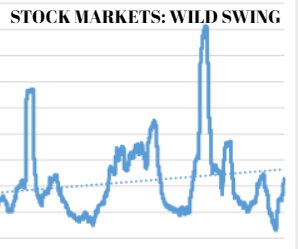

The Indian bourses witnessed a wild, pendulum swing today. The Sensex saw an intra-day high of 52673 points and a low of 51802 points before settling at 52443, 135 points lower than the day's opening mark. It was a swing of 871 points. The Nifty showed similar trend to touch a high of 15767 points and a low of 15513 points before closing the day at 15709. The intra-day swing in Nifty was 254 points. The continued slide for the last three sessions has meant that investors have lost Rs 1 lakh crore in market capitalization.

While profit taking played a huge role in this slide, the market was also spooked by the crackdown on tech companies by the Chinese government and the upcoming US Fed meeting and the expiry of the July F&O. While the external factors did weigh in, the slide was mainly due to operators squaring up their F&O positions before the expiry of July series and profit taking at higher levels.

But what was most heartening was to see the huge support at crucial levels that prevented a major slide and propped up the market. The very fact that there was huge buying support across sectors at lower levels was instrumental in pulling up the Sensex from 51802 points to its closing level of 52443 points and preventing the bears from tightening their grip. The buying support shows that investors are upbeat about the economy and are still looking for bargains. This augurs well for upcoming sessions although the IMF downgrade is a dampener.