By Ashwini Agarwal

First publised on 2020-02-05 18:14:30

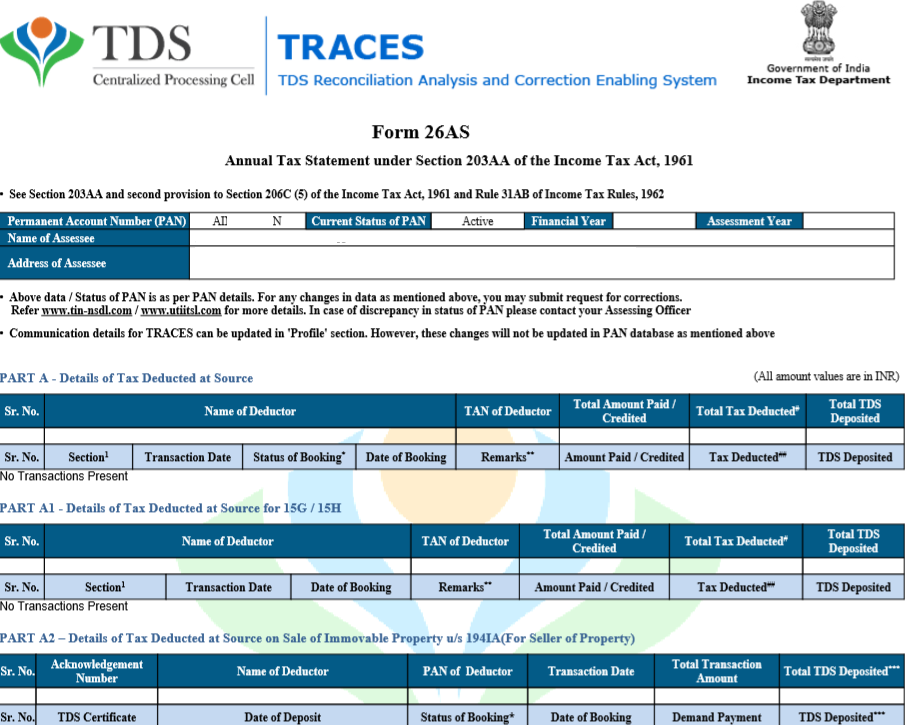

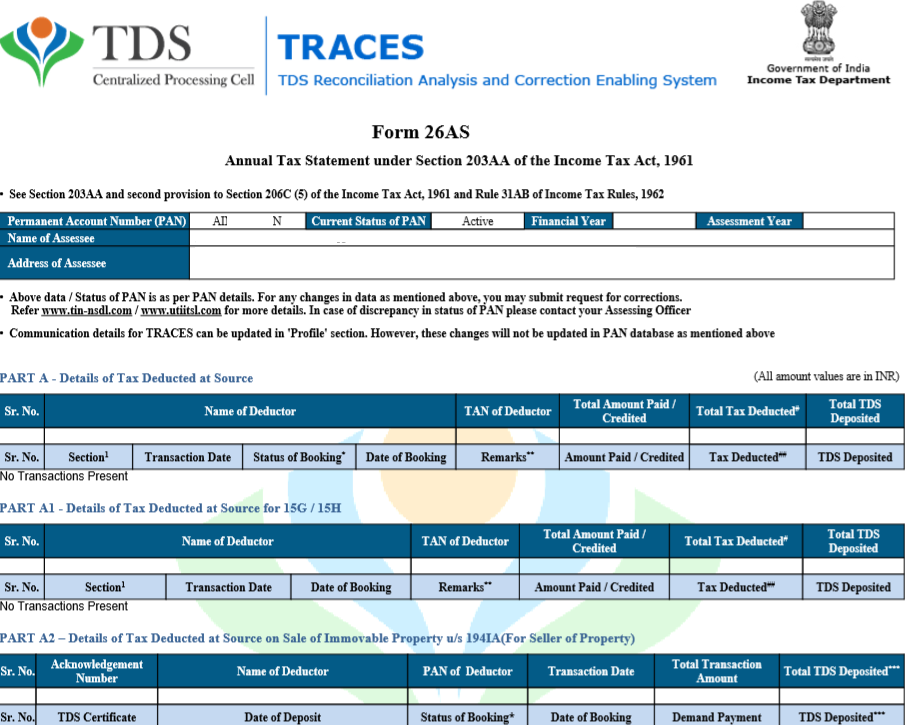

In a dual effort to both simplify matters for the taxpayer and plug the loss of revenue, this yearâs budget has changed the way Form 26AS will report transactions. Its scope has been widened from just reporting TDS deductions and other prepaid taxes from various sources, including, but not limited to, salaries and bank fixed deposits.

The finance minister had proposed to introduce section 285BB that will make Form 26AS a comprehensive annual income statement and will include transactions such as immoveable property and shares purchased or sold, among other things. Hence, section 203AA, under which the Form 26AS is now created will be deleted.

The new Form 26AS will have information collected by the income tax department from sources such as state property registrars, stock exchanges, banks, mutual funds and EPFO. This will make easier for the department to provide the taxpayer with a more comprehensive pre-filled ITR on the one hand while on the other, it will ensure that the taxpayers report all incomes truthfully and revenue is not lost.

At present, Form 26AS contains information about TDS deducted from sources such as salary, bank fixed deposits and also the taxes collected from the taxpayer or paid by him. In effect, it is a statement of tax deducted, collected or paid. But now it will be converted to a statement of all reported transactions, whether or not it involved deduction or payment of tax. This is possible only because all financial transaction have now to be done by providing the PAN and are digitally recorded.

Although the taxpayer will have the benefit of getting a comprehensive and pre-filled ITR based on this new Form 26AS, it will the duty of the taxpayer to cross-check all information and tally with his actual transactions. In order to ensure that he or she does not file a defective return, the taxpayer will need to report any wrong information in Form 26AS and rectify the ITR accordingly.